- Admin

- Personal Finance's, Rules

- 0 Comments

- 3151 Views

20k to Financial Independence: Achieving financial freedom is a dream for many, but the path to it can often seem unclear and daunting. However, with the right strategies and discipline, it’s entirely possible to attain significant wealth and security by the age of 40. This guide will outline a detailed financial plan tailored for someone starting with a modest monthly income, focusing on long-term investments and disciplined saving habits.

Understanding Your Current Financial Situation

Before diving into investment strategies, it’s crucial to understand your current financial situation. Let’s take an example:

- Monthly in-hand income: ₹20,000

- Major monthly expenses:

- Travel: ₹6,500

- Course EMI: ₹10,000 (remaining for 7 months)

- Gold scheme: ₹2,000 (remaining for 9 months)

- Savings: ₹1,500

- Current bank balance: ₹5,000

Immediate Financial Planning Steps

Step 1: Insurance

Life Insurance

- Purchase a life insurance policy around the age of 30. Choose a term insurance plan that covers you until the age of 60-65.

Health Insurance

- Ensure that you and your parents are covered under a comprehensive health insurance plan. If your parents have health insurance that includes you, this is sufficient for now. Plan to buy your own health insurance policy by the age of 30 or when you start your own family.

Investment Strategy

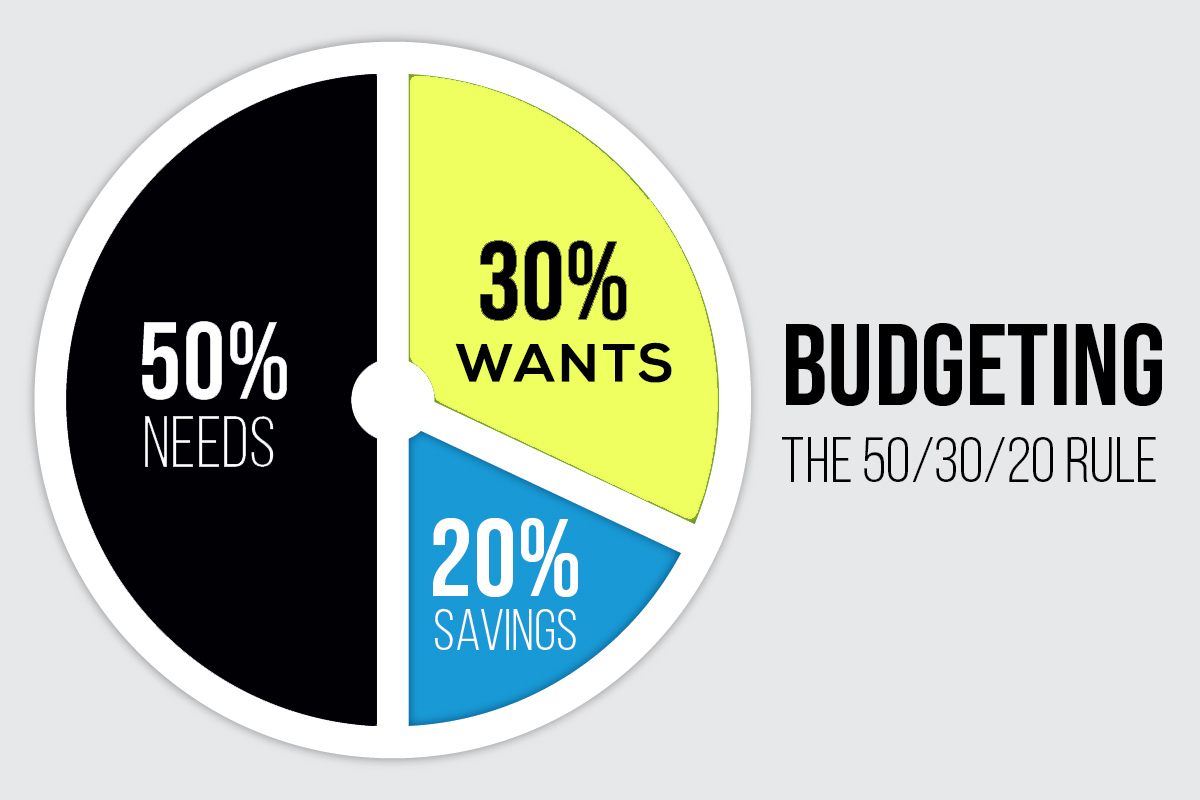

The 50-30-20 Rule

This rule is a guideline for budgeting your income:

- 50% for Needs: Essential expenses such as travel and education.

- 30% for Wants: Discretionary spending, which can be adjusted based on your financial goals.

- 20% for Investments: Savings and investments for future financial security.

In this example, the budget would be:

- Needs: ₹10,000

- Wants: ₹6,000

- Investments: ₹4,000

Currently, the expenses are:

- Needs: ₹16,500 (travel and course EMI)

- Wants: ₹0

- Investments: ₹2,000 (gold scheme)

After the course EMI ends in 7 months, reallocate these funds into investments.

SIP (Systematic Investment Plan) Strategy

For the next 7 months:

- Invest ₹800 in Nifty 50 index funds (large-cap).

- Invest ₹400 in mid-cap index funds.

- Invest ₹300 in small-cap index funds.

After the course EMI ends:

- Increase SIP to ₹3,000 in Nifty 50 index funds.

- Invest ₹1,800 in mid-cap index funds.

- Invest ₹1,200 in small-cap index funds.

This increases your total monthly investment to ₹6,000.

Long-term Financial Projections

By following the above investment strategy and increasing your SIP by 10% annually, you can expect significant growth in your investments. Assuming an average annual return of 12%, here’s what your financial future could look like:

- In 15 years: Approximately ₹1.8 crore (₹1.8 CR).

- In 35 years: Approximately ₹320 crore (₹320 CR).

These projections highlight the power of compounding and long-term investing. Even with modest initial investments, consistent contributions can lead to substantial wealth over time.

Selecting the Right Mutual Funds For 20k to Financial Independence

When choosing mutual funds for your SIPs, consider the following criteria:

- Expense Ratio: Look for funds with a low total expense ratio (between 0.5% to 1.5%).

- Exit Load: Prefer funds with zero exit load to avoid penalties when redeeming.

- Performance and Brand: Select well-established funds with a strong performance track record over the long term.

Conclusion of 20k to Financial Independence

Financial freedom is achievable with careful planning and disciplined investing. By following this comprehensive guide and adjusting your budget to prioritize investments, you can build a secure and prosperous financial future. Start with small, consistent investments and gradually increase them as your income grows. Remember, the key to financial success is long-term thinking and the magic of compounding.